Alphabet: Antitrust Suits Will Weaken Google's Dominance

IntroductionIn this write-up, I will discuss the antitrust risks Alphabet (GOOG) is currently facing. In my opinion, Alphabet is facing the most substantial antitrust risks out of all the big tech firms, but this has been overshadowed for years by controversies surrounding Facebook (FB), Apple (AAPL) and Amazon (AMZN). There are tons of reports from reputable news agencies mentioning that the DOJ and a group of states are separately investigating Google's dominance in multiple market segments. However, the sources in these reports are most often anonymous sources or Google's direct competitors like DuckDuckGo. Therefore it might be a possibility that these reports are partially incorrect. In this article, I will discuss Google's dominance in-depth, discuss in which market segments Google's dominance might be weakened if antitrust suits occur and answer the question on everyone's mind: should investors worry about any potential antitrust lawsuits?

AntitrustU.S. federal and state authorities are ready to start filing antitrust lawsuits 'as soon as summer' according to 'people familiar with the case'. However, a decision to actually file still needs to be made. The group of states is likely focusing on Google's 'online advertising business', according to Wall Street Journal sources familiar with the case, while the DOJ is likely taking a broader approach focusing on Google's dominance in online search, but also their approach has likely focused more on Google's ad tools over time, according to Wall Street Journal sources.

'U.S. Attorney General William Barr has made the Google probe a top priority, and Paxton says the states aren't slowing down on their investigation.'~Seeking Alpha

There are multiple reports from multiple reputable news agencies that are giving off the impression that authorities are genuinely trying to get a foot in the door at Alphabet. I assume this is because of Google's dominance in the advertising space:

'The company(Google) owns the dominant tool at every link in the complex chain between online publishers and advertisers.'~the Wall Street Journal

Now I will discuss that supposed dominance split amongst multiple market segments. Eventually, the reader will understand that all these different segments are actually intertwined together.

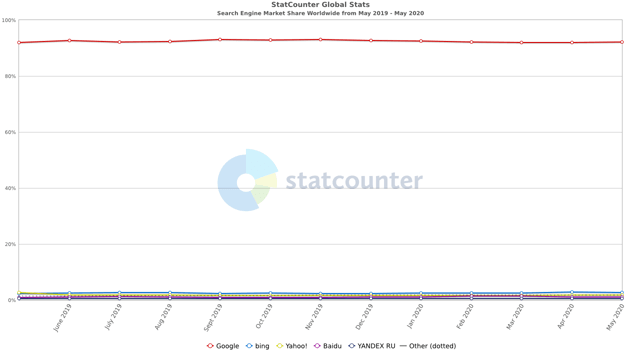

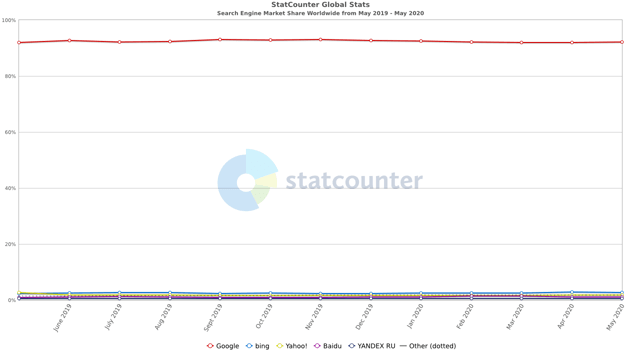

Search EngineThe first market segment where regulators might think Alphabet is too dominant is in search. Google's market share in the worldwide search engine market is immense but has somewhat decreased over the last few years. Google's market share in April 2020 was 92% according to statcounter. Yet Google's dominance in the search engine market still gave smaller competitors the opportunity to become profitable, both, Bing and DuckDuckGo are profitable businesses.

(Source: Statcounter)

On the other hand, the broader search market is starting to get more heated. Amazon is not a search engine but does provide search services on its website. Amazon's strong foundation in the e-commerce market has caused customers to use Amazon.com directly when searching for goods. Consequently, Amazon has seen high growth rates in search ad revenues. Previously users would have started searching on Google, which is very lucrative to Alphabet shareholders, but now they search on Amazon directly. With Amazon's dominance increasing Google is estimated to start losing search revenues to Amazon.

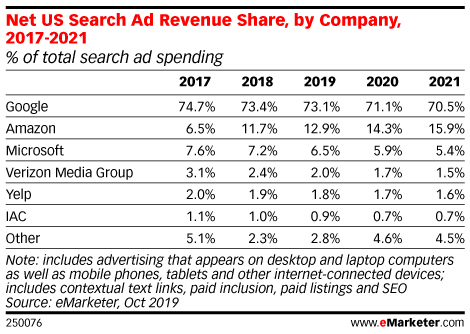

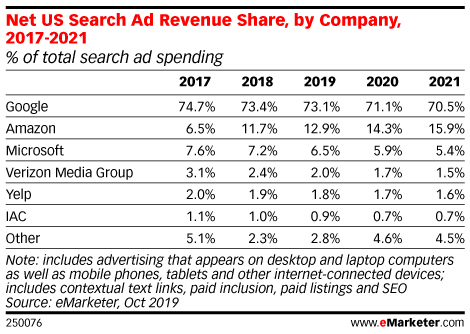

According to eMarketer Google's slice of the US's search revenue remains massive, at a whopping 73.1% in 2019. However, Amazon is forecasted to become a formidable second player in a couple of years time.

"Amazon’s ad business, for example, has attracted massive increases in ad spending because advertisers can reach audiences via interest-based signals—product queries—and in a context where they’re ready to buy." ~eMarketer

(Source: eMarketer)

"U.S. federal and state authorities are asking detailed questions about how to limit Google’s power in the online search market as part of their antitrust investigations into the tech giant, according to rival DuckDuckGo Inc." ~Bloomberg

According to Google's competitor DuckDuckGo, authorities are interested in giving costumers more search alternatives on Android devices and the Chrome browser. This would quite certainly be great for DuckDuckGo. In Google's defence, changing your search engine on Chrome from Google to DuckDuckGo can be done in seconds. But it is plausible that Chrome users in the future will not get Google as a default browser, but instead, need to choose their own default browser.

I do not suspect any major changes will occur in the search engine market due to regulatory intervention, but it remains a possibility. I mostly assume risks are low since Google can make the point that Amazon is continuing to grow market share in the search business and that its other direct search engine competitors are profitable.

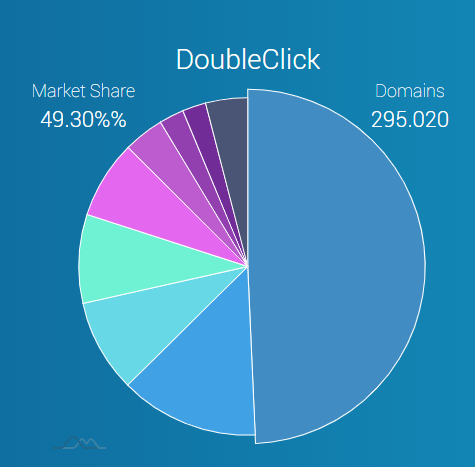

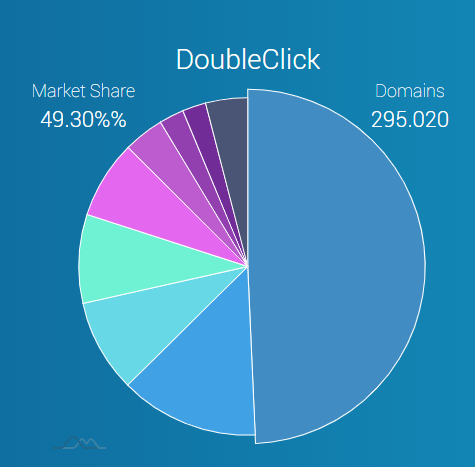

Digital ad marketThe second market segment where regulators may believe Alphabet has a too dominant position is the digital ad market. For a reader to comprehend Alphabet's dominance in the digital ad market, one has to understand this principle first. The effectiveness of an advertisement can be improved by a better understanding of the users, more data results in a higher understanding and so higher effectiveness. Alphabet owns the biggest ad exchange on the internet, DoubleClick Ad Exchange, which has close to a 50% market share. Ad exchanges are the intermediary between third-party websites and advertisers. The DoubleClick Ad Exchange is a vital component of DoubleClick. DoubleClick is known as an ad server, this is a platform that connects websites who want to sell ad spaces with ad exchanges, this includes DoubleClick's own ad exchange but also other ad exchanges. One thing is vital to understand here, according to the Wall Street Journal 'more than 90% of large publishers use the Google ad server, DoubleClick for Publishers'. Why is this vital? According to the FT, Ad servers can track the activity on websites that use the ad server. So in theory, Google is able to obtain tons of browsing data from most high traffic websites.

(Source: Datanyze)

Alphabet obviously owns Google properties: YouTube, Google Search, Google Maps, Google Images, Gmail and the list goes on and on. As I said earlier more data results in more effective ads and so higher margins, higher market share etc. It is plausible that Google can use data obtained from the DoubleClick services to increase the effectiveness of ads on Google Properties.

“In between advertisers and publishers, the leading intermediary is Google. They own most of the technical stack between advertisers and publishers.” ~Damien Geradin, a law scholar

One can seriously ask whether it is a fair market that Alphabet owns DoubleClick, while at the same time owning all the valuable Google properties. According to the Wall Street Journal, Elizabeth Warren 'has proposed unwinding the Google-DoubleClick merger'.

Google's platform Adwords, which is Google Search's ad platform, allows advertisers to buy ad spaces from AdX, DoubleClick's ad exchange. So Google Properties are driving sales to AdX. According to the Wall Street Journal, Google now also allows rival exchanges to sell ad spaces on Google Adsense.

This showcases how connected all these different platforms are, and how difficult it is to comprehend Google's dominance in the digital ad market.

Any regulator diving deep into Google's business model is facing multiple problems. First, they need to understand Google's business very well, to be able to comprehend all the moving pieces. After that, they face the problem of how to showcase the dominance, because frankly, Google's business model is more complicated than one might think.

"I’m hoping that we bring it to fruition early summer, and by fruition I mean, decision time.” ~Mr. Barr, referring to the Google probe.

However, the most difficult question, in my opinion, for any regulator going after Google, is how to combat this dominance. Splitting up the companies into a separate Google properties entity and a DoubleClick entity might not solve the problem entirely, yet could be an improvement. One scenario I can imagine is the separate firms just buying the data from each other, but at least now, in theory, other big players would be able to attain the data as well, though Google's capital makes it hard to outbid them. This creates a somewhat fairer playing field.

In general, a split-up of Google and DoubleClick might be very difficult, according to lawyers who spoke to CNBC. The problem is that over time Google and DoubleClick have become very intertwined, making it challenging to split them up.

"Courts are very concerned that by ripping a company apart, it hurts consumers and make it worse for people that don’t have the expertise to do that"~Stephen Houck, Google advisor

The group of states have not ruled out the possibility of trying to split Google up according to CNBC sources. The question regulators and potentially judges need to answer is whether a split-up does more harm than good or more good than harm.

In 2008 the Federal Trade Commission had to decide whether Google was allowed to take over Doubleclick. Eventually, they gave their permission. According to the Wall Street Journal, a former FTC official said:

"At the time, it seemed like the right decision, but things changed a lot in the last dozen years"

I believe it is somewhat likely that regulators will try to split up Alphabet and DoubleClick. I suspect that it could weaken Alphabet's moat in the digital ad market quite substantially.

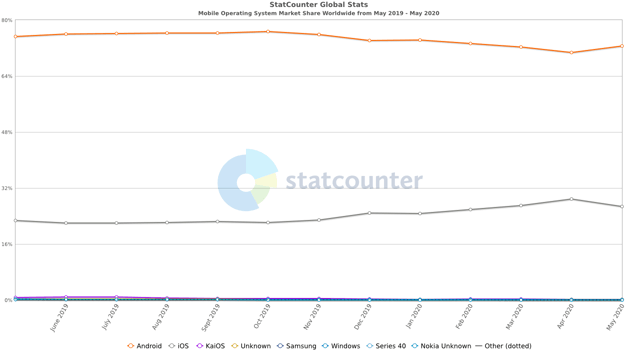

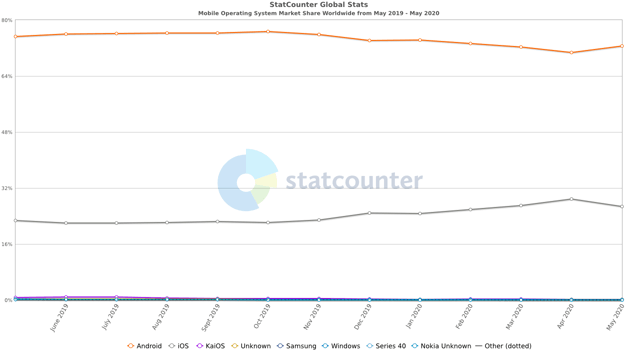

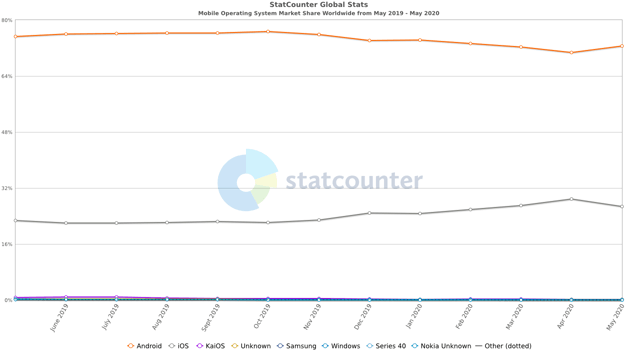

AndroidAccording to Politico sources, one other potential settlement would involve Google spinning off its control of the Android mobile operating system. This has been a controversial topic for years. Android has a dominant market share in the mobile operating system market.

(Source: statcounter)

(Source: statcounter)

This is, in my opinion, is the biggest risk to Alphabet shareholders, since Android is a very valuable operating system, and regulators might make an adequate case that Google should not own Android. Alphabet uses Android to force its own Google properties, YouTube, Chrome and Gmail, onto Android customers, which does not bode well with the fair market principle and strengthens its dominance in multiple market segments. And it is quite a rodeo to remove the pre-installed apps. Remember, more data means more effective ads, and so Google is using Android's dominance to acquire more data with its Google properties about users. The European Commission actually fined Alphabet with €4.3 billion for using Android's dominance to 'strengthen dominance of Google's search engine'.

"The Commission decision concludes that Google is dominant in the markets for general internet search services, licensable smart mobile operating systems and app stores for the Android mobile operating system."~European Commission

"Google's practice has therefore reduced the incentives of manufacturers to pre-install competing search and browser apps, as well as the incentives of users to download such apps. This reduced the ability of rivals to compete effectively with Google."~European Commission

I deem it as very plausible that eventually, Android needs to be separated from Alphabet, or that Android is no longer allowed to be pre-installed with some of the Google properties. They also own the biggest ad-exchange AdMob for third-party apps, this is very comparable to DoubleClick's ad exchange that also connects advertisers with advertising spaces. I imagine regulators might be critical of Google owning AdMob, and the strategy used to grow AdMob. According to Reuters:

"The biggest choice for many app creators is between Google’s AdMob and DoubleClick. It is not clear which is growing faster because Google does not provide that data."

"Still, Google’s strategy is winning customers. Google gives developers about 70 cents of every $1 it collects from ad buyers, compared to 50 cents to 60 cents at some competitors."

Android

is another piece of the complicated Google puzzle, this section

showcases again how intertwined all different Google Properties truly

are.

Android

is another piece of the complicated Google puzzle, this section

showcases again how intertwined all different Google Properties truly

are.

(Source: statcounter)

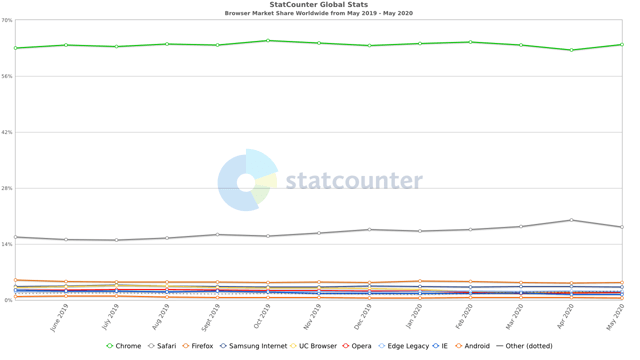

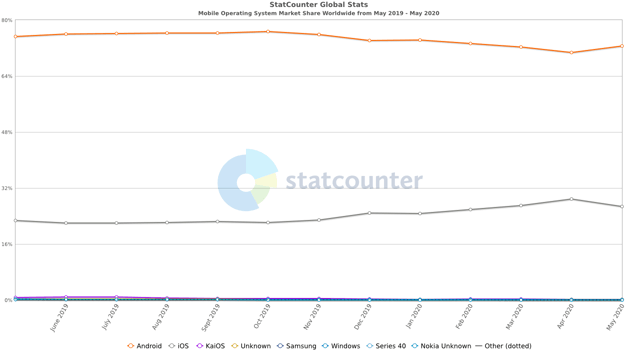

ChromeGoogle's successful browser Chrome might also be involved in any potential settlement with regulators. According to statcounter, Chrome has a whopping 64% market share of the browser market. The success of the browser can be partially associated with its well-built foundation, but its success is not caused by technical details alone. Google preinstalls Chrome on Android devices, and Chrome is practically advertised on Google search and some other Google properties.

(Source: Techdows)

Google used its dominance in other areas to force Chrome

onto users. I see it as unlikely that Chrome is separated from the

entire company by a regulator, but I deem it as likely that Chrome will

undergo some minor change. This might involve Google no longer using its

other properties to gain Chrome users.

(Source: statcounter)

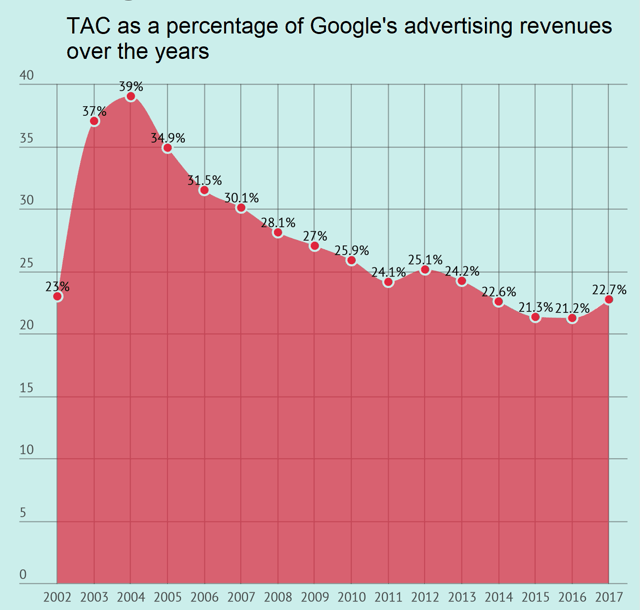

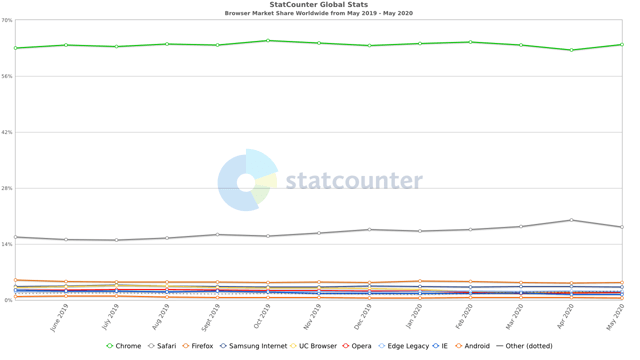

TACTraffic acquisition costs, TAC, are a great way to determine whether Google is using its dominance in some market segments to lower the costs of acquiring traffic to its services. These traffic acquisition costs include 'partnerships and distribution deals'. Partnerships can be websites, apps or YouTube channels, that are using Google's DoubleClick, AdMob or Adsense program, the third party's share of the revenue is a traffic acquisition cost for Google. In distribution deals, Google, for example, pays companies to include Google software on their phones.

Google can, in theory, use its ad dominance to lower the TAC. For example, Google can take a bigger slice when putting ads on third-party properties, this is the DoubleClick and AdMob platform we discussed. There are many ways Google can use its dominance to lower the TAC. But one thing is clear, the TAC costs relative to Google's revenues have decreased over time. One side note, this includes all Google Properties, and so also Google Search and Gmail. Since Google owns Google Search and Gmail, and both services have strong moats, the TAC/Revenue will be very low. What the trend is revealing is that Google has been able to expand gross margins. My guess is that Google Search is the driving factor. Yet there are many factors in play making it hard to determine what has driven the TAC/revenue down.

(Source: Fourweekmba)

(Source: Fourweekmba)

From 2018 to 2019 the TAC share of Google's revenues decreased from 19.65% to 18.26%. Again, this showcases that Google is continuing to grow revenues while expanding its gross margins. A great business model. However, this also showcases that Google might be abusing its power for shareholders. That is the question regulators need to answer.

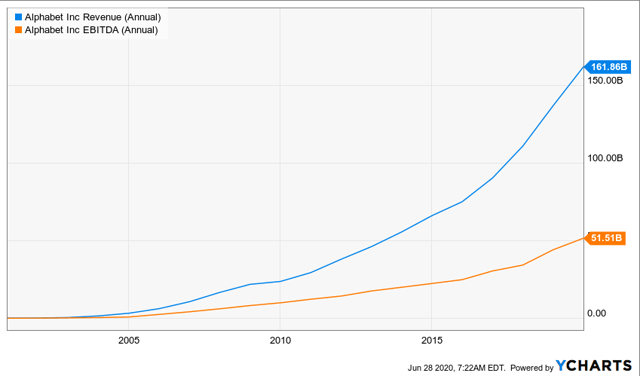

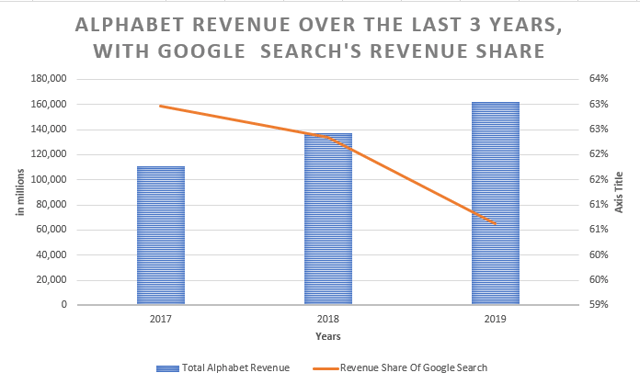

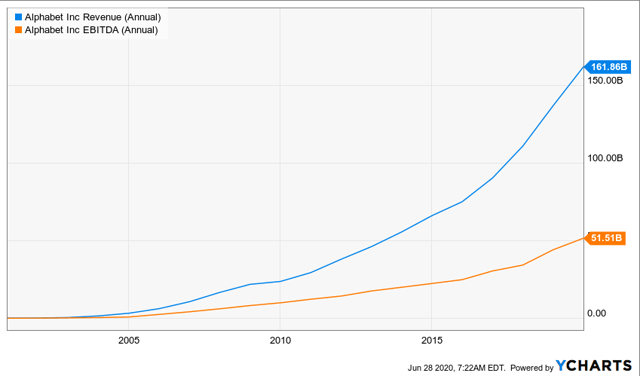

Wonderful companyAlphabet is the conglomerate with Google as one of its subsidiaries. Alphabet's consistent revenue and EBITDA growth have been stellar, to say the least. Google's profitable search business has been the strong foundation that has given Alphabet the capital to grow extensively.

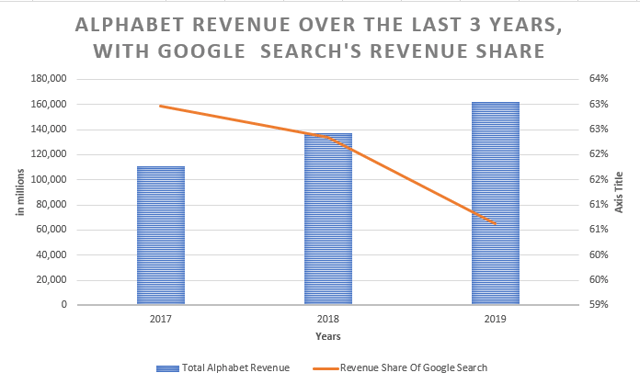

Alphabet

is very slowly diversifying its company away from Google Search and

other Google properties. Every year Google's Search share of Alphabet's

total revenue has declined and I expect this trend to continue.

Currently, Google is creating most of the value for Alphabet

shareholders since Google's operating income in Q1 2020 was $9.270

billion and Alphabet's operating income $7.977 billion, this means

Alphabet's newer investments are currently losing the company money.

Except these are long-term investments and include money-losing

companies like SpaceX and Waymo that are ready to change the world.

Alphabet

is very slowly diversifying its company away from Google Search and

other Google properties. Every year Google's Search share of Alphabet's

total revenue has declined and I expect this trend to continue.

Currently, Google is creating most of the value for Alphabet

shareholders since Google's operating income in Q1 2020 was $9.270

billion and Alphabet's operating income $7.977 billion, this means

Alphabet's newer investments are currently losing the company money.

Except these are long-term investments and include money-losing

companies like SpaceX and Waymo that are ready to change the world.

(Source: Visualized in Excel, data from Alphabet IR)

(Source: Visualized in Excel, data from Alphabet IR)

Owning Alphabet comes with regulatory risks. The showdown between regulators and Microsoft in the 1990s is a comparable situation. Microsoft (MSFT) was in an antitrust suit with the DOJ, the DOJ was trying to make the case that Microsoft was using its operating system dominance to grow Internet Explorer. They came to a settlement where Microsoft, among other things, had to accept other browsers on Windows. Without this suit, in my opinion, Google could have never existed. Microsoft's Bing would have been the Google of today. The irony is that Google might not be respecting the free market, that gave Google the opportunity to exist. This gigantic lawsuit in the 1990s against Microsoft tarnished the strong brand of Microsoft, and slowed Microsoft down in terms of innovation:

'There’s no doubt that the antitrust lawsuit was bad for Microsoft, and we would have been more focused on creating the phone operating system and so instead of using Android today you would be using Windows Mobile.'~Bill Gates

Nicholas Economides, a respected academic, also wrote an extensive analysis of the Microsoft antitrust lawsuit, while it was still ongoing. He wrote:

'The biggest loss to Microsoft is the continuous antitrust scrutiny that does not allow it to make significant acquisitions in telecommunications and the Internet in the United States during the period of intense antitrust scrutiny.' ~Nicholas Economides

Microsoft's example showcases that antitrust suits can be detrimental to the innovation power of a company, that is a risk Alphabet shareholders need to consider.

TakeawayIt is uncertain what the consequences of any potential antitrust suit against Alphabet will be, frankly it is still possible that an antitrust suit never gets filled. I do believe that any antitrust case can lead to a weakened dominance in some markets. For example, Google Chrome might lose market share, Google might have to leave the mobile operating system market, Google might have to spin-off Doubleclick and/or Admob, and Google's innovation power might be weakened if a hypothetical antitrust case takes ages, and starts getting heated. These are realistic examples that result in Google's dominance being weakened. These hypothetical scenarios will obviously affect Alphabet shareholders, but I suspect less than people might fear. 73% of Google's advertising revenues in 2019 comes from Google Search, only 17% from Google Network Members, that includes Admob and Doubleclick. I also suspect that the margins of Google Search are much higher than of the other Google advertising segments. I find it unplausible that Google Search revenues will be affected significantly, and since these contribute a majority of the profits, I deem any consequences to the bottom line to be minor.

In short, I believe investors should not worry too much about regulatory risks, but understand that Google might undergo some change and as a consequence that Google's moat in some areas might be weakened. Alphabet truly is a wonderful company, that has been able to reward shareholders for decades, and I believe they will continue to do so.

Did you enjoy my write-up? I write a lot about internet and undercovered European stocks, remember to follow me to be able to get notified whenever I publish a new article. You can follow me by scrolling back up and clicking the follow button next to my profile.

Disclosure: I am/we are long FB, AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Some of the research contained in this article might not be entirely accurate, as many as sources as possible were used to prove its worth, however inaccuracies may still occur. This article is meant as an analysis to inform investors what any hypothetical antitrust suits might involve. This article is in no way meant to be libelous. I recommend investors to do their own due diligence.

Why Google Pulled Ads From Two Conservative Websites

Two conservative sites had their AdSense ads pulled from their sites. Lost amid the cries of censorship was the real reason the ads were removed: Failure to understand Google’s terms and conditions they agreed to.

That failure led to content violations which caused their advertising to temporarily be removed by Google.

User Generated Content and AdvertisingUser generated content (UGC) is content that is created by site visitors and not the website publisher themselves. On news sites this kind of content takes the form of comments.

News sites in the past focused on presenting current events. The Internet changed not only how content is consumed but it also changed what kind of content is consumed.

Publishers grew to understand that certain kinds of content that makes readers outraged or angry tend to attract more visitors.

Even mainstream news sites craft articles designed to provoke outrage in order to encourage social sharing and high readership.

The downside of that is that commenters are in an agitated state and that can lead to problematic comments being posted, including hate speech.

ADVERTISEMENT

CONTINUE READING BELOW

Why Advertising and User Generated Content Can be ProblematicGoogle has been criticized in the past for showing advertising on pages that are advertisers might not want associated with their brands.

That’s why Google has policies that forbid showing advertising on pages that feature hate speech, speech of an erotic nature, and content that is graphic and violent.

Many brands do not want to be associated with offensive content.

Showing their ads on pages with offensive content sends the signal that the advertisers approve of and support that offensive content.

Advertisers generally prefer that their content do not appear on pages with problematic content.

Publishers are obligated by their agreement to show Google AdSense ads to be mindful of that kind of negative content.

But that doesn’t always happen. Failure to understand AdSense policies is what caused The Federalist and Zero Hedge to become the object lessons of the day.

ADVERTISEMENT

CONTINUE READING BELOW

Google Did Not Ban the News PublishersThe action Google took appears to be what Google calls a Publisher Restriction.

A Publisher Restriction is a TEMPORARY halt to ad serving until offensive content is removed.

The Publisher Restriction system gives publishers a notice that their ads have been temporarily suspended until the policy violation is corrected.

The intent of this system is to give publishers a chance to correct the issue and continue providing ad space that advertisers won’t be upset about.

This is meant to be a gentler approach than an outright lifetime ban.

What happened was not censorship. It was a failure by the publishers to be aware of the AdSense terms and conditions that they agreed to when signing up to show AdSense ads.

This kind of action happens to all kinds of sites. It has ZERO to do with politics and everything to do with violating Google’s policies against problematic content.

Any site that allows user generated content has to keep their comments in line with Google’s terms of service in exchange for the privilege to display AdSense ads.

The Federalist fixed the issue and had their advertising restored.

Google then issued a statement about content that is problematic:

How to Deal with User Generated ContentThere are several ways to deal with UGC. The first is to moderate content. One way to accomplish this is to either pay someone to moderate the commenting community or to enlist responsible users to become moderators.

A good way to prevent problematic UGC is to publish a content policy.

Adding a “Report a Thread” function gives users the ability to report problematic content.

TakeawayBeing an online publisher means having to wear multiple hats. One of the hats is managing advertising on a website. And that means someone needs to be responsible for understanding Google’s AdSense Program Policies.

ADVERTISEMENT

CONTINUE READING BELOW

None of this would have happened had someone at the Federalist and Zero Hedge been on top of the issue of problematic content. All publishers are obligated to understand these policies in order to show advertising because it’s what they agreed to when they joined the AdSense program.

Learn from the ‘Godfather of Google AdSense’ on what gets investors to fund a startup

Entrepreneurs and startups on the lookout for investors and funding is a perpetual, ever-lasting cycle – the kind that has even spurned reality TV shows!

However, much like the spirit of entrepreneurship itself, which rests on going down the offbeat path, is the phenomenon of reverse pitching. The core idea is to flip the script and have investors pitch to startups instead, with the former sharing their operational experience, sector focus, investment thesis, ticket sizes, portfolios and the value propositions that they bring to the table. This is followed by a Q&A Session where founders can ask the investors questions.

Organisations like Amazon AWS, TiE, The Circle.Work, Network Capital, Headstart, etc. are the marketing partners for this series.

Leading the way in making reverse pitching mainstream, and in the process, demystifying startup funding for founders, is Delhi-based Favcy — a venture building platform providing ready-to-assemble digital applications to convert ideas into a venture — with a bi-weekly digital Reverse Pitch session.

The Favcy Reverse Pitch series of webinars have so far featured several big names from the VC space, including Vinod Shankar (Partner, Java Capital), Shashank Randev (Founder VC,100x.VC), Rajul Garg (Founding and Managing Partner, Leo Capital), Satveer Thakral (CEO, SGAN) and Pinaki Aich (CEO, Forward Investments), among others, to conduct successful, engaging sessions on reverse pitching.

Raising the bar higher this coming week, the Favcy Reverse Pitch is now set to host the ‘Godfather of Google AdSense', Gokul Rajaram on Monday, June 8 at 10 am. To register for this webinar, click here.

Gokul currently serves on the executive team at DoorDash where he leads Caviar — a premium food ordering service. He was also instrumental in getting Facebook Ads to go mobile-first, and has served as a senior figure across some of the largest tech companies in the world, namely Google, Facebook and Square.

“This is a great opportunity for founders to understand investors’ investment thesis, ticket size, what makes them invest into companies new trends and much more in a 25 minute chat. They also have the opportunity to ask the investors critical questions in a 15 minute Q&A Session,” said Nischaiy Pradhan, Founding Partner at Favcy.

Here’s why you shouldn't miss this sessionLearn about Gokul Rajaram’s investment thesis

Gokul has made a broad spectrum of investments from Shape Security, People AI to Faire (an online wholesaler catering to resellers), while tech-play is a Business Model Innovation. In this session, he will delve deeper into what makes hand out a cheque.

Critical Startup Evaluation

Gokul will be sharing mental models on how a founder can rate and evaluate themselves and their startup at an early stage on metrics like Product Market Fit, Founder Market Fit, Timing the Market, etc.

Uptrends in the Post-Covid World (Both American and Indian Context)

Gokul will be sharing his views on sectors and opportunities that he thinks will be on the positive side of COVID from the perspective of both the American and Indian markets.

Don’t miss out on this fantastic opportunity to help kick-start your startup’s growth and make use of the seed money to bear much fruit. You can find out more and register for this special session hereWant to make your startup journey smooth? YS Education brings a comprehensive Funding Course, where you also get a chance to pitch your business plan to top investors. Click here to know more.

Alphabet: Antitrust Suits Will Weaken Google's Dominance

IntroductionIn this write-up, I will discuss the antitrust risks Alphabet (GOOG) is currently facing. In my opinion, Alphabet is facing the most substantial antitrust risks out of all the big tech firms, but this has been overshadowed for years by controversies surrounding Facebook (FB), Apple (AAPL) and Amazon (AMZN). There are tons of reports from reputable news agencies mentioning that the DOJ and a group of states are separately investigating Google's dominance in multiple market segments. However, the sources in these reports are most often anonymous sources or Google's direct competitors like DuckDuckGo. Therefore it might be a possibility that these reports are partially incorrect. In this article, I will discuss Google's dominance in-depth, discuss in which market segments Google's dominance might be weakened if antitrust suits occur and answer the question on everyone's mind: should investors worry about any potential antitrust lawsuits?

AntitrustU.S. federal and state authorities are ready to start filing antitrust lawsuits 'as soon as summer' according to 'people familiar with the case'. However, a decision to actually file still needs to be made. The group of states is likely focusing on Google's 'online advertising business', according to Wall Street Journal sources familiar with the case, while the DOJ is likely taking a broader approach focusing on Google's dominance in online search, but also their approach has likely focused more on Google's ad tools over time, according to Wall Street Journal sources.

'U.S. Attorney General William Barr has made the Google probe a top priority, and Paxton says the states aren't slowing down on their investigation.'~Seeking Alpha

There are multiple reports from multiple reputable news agencies that are giving off the impression that authorities are genuinely trying to get a foot in the door at Alphabet. I assume this is because of Google's dominance in the advertising space:

'The company(Google) owns the dominant tool at every link in the complex chain between online publishers and advertisers.'~the Wall Street Journal

Now I will discuss that supposed dominance split amongst multiple market segments. Eventually, the reader will understand that all these different segments are actually intertwined together.

Search EngineThe first market segment where regulators might think Alphabet is too dominant is in search. Google's market share in the worldwide search engine market is immense but has somewhat decreased over the last few years. Google's market share in April 2020 was 92% according to statcounter. Yet Google's dominance in the search engine market still gave smaller competitors the opportunity to become profitable, both, Bing and DuckDuckGo are profitable businesses.

(Source: Statcounter)

On the other hand, the broader search market is starting to get more heated. Amazon is not a search engine but does provide search services on its website. Amazon's strong foundation in the e-commerce market has caused customers to use Amazon.com directly when searching for goods. Consequently, Amazon has seen high growth rates in search ad revenues. Previously users would have started searching on Google, which is very lucrative to Alphabet shareholders, but now they search on Amazon directly. With Amazon's dominance increasing Google is estimated to start losing search revenues to Amazon.

According to eMarketer Google's slice of the US's search revenue remains massive, at a whopping 73.1% in 2019. However, Amazon is forecasted to become a formidable second player in a couple of years time.

"Amazon’s ad business, for example, has attracted massive increases in ad spending because advertisers can reach audiences via interest-based signals—product queries—and in a context where they’re ready to buy." ~eMarketer

(Source: eMarketer)

"U.S. federal and state authorities are asking detailed questions about how to limit Google’s power in the online search market as part of their antitrust investigations into the tech giant, according to rival DuckDuckGo Inc." ~Bloomberg

According to Google's competitor DuckDuckGo, authorities are interested in giving costumers more search alternatives on Android devices and the Chrome browser. This would quite certainly be great for DuckDuckGo. In Google's defence, changing your search engine on Chrome from Google to DuckDuckGo can be done in seconds. But it is plausible that Chrome users in the future will not get Google as a default browser, but instead, need to choose their own default browser.

I do not suspect any major changes will occur in the search engine market due to regulatory intervention, but it remains a possibility. I mostly assume risks are low since Google can make the point that Amazon is continuing to grow market share in the search business and that its other direct search engine competitors are profitable.

Digital ad marketThe second market segment where regulators may believe Alphabet has a too dominant position is the digital ad market. For a reader to comprehend Alphabet's dominance in the digital ad market, one has to understand this principle first. The effectiveness of an advertisement can be improved by a better understanding of the users, more data results in a higher understanding and so higher effectiveness. Alphabet owns the biggest ad exchange on the internet, DoubleClick Ad Exchange, which has close to a 50% market share. Ad exchanges are the intermediary between third-party websites and advertisers. The DoubleClick Ad Exchange is a vital component of DoubleClick. DoubleClick is known as an ad server, this is a platform that connects websites who want to sell ad spaces with ad exchanges, this includes DoubleClick's own ad exchange but also other ad exchanges. One thing is vital to understand here, according to the Wall Street Journal 'more than 90% of large publishers use the Google ad server, DoubleClick for Publishers'. Why is this vital? According to the FT, Ad servers can track the activity on websites that use the ad server. So in theory, Google is able to obtain tons of browsing data from most high traffic websites.

(Source: Datanyze)

Alphabet obviously owns Google properties: YouTube, Google Search, Google Maps, Google Images, Gmail and the list goes on and on. As I said earlier more data results in more effective ads and so higher margins, higher market share etc. It is plausible that Google can use data obtained from the DoubleClick services to increase the effectiveness of ads on Google Properties.

“In between advertisers and publishers, the leading intermediary is Google. They own most of the technical stack between advertisers and publishers.” ~Damien Geradin, a law scholar

One can seriously ask whether it is a fair market that Alphabet owns DoubleClick, while at the same time owning all the valuable Google properties. According to the Wall Street Journal, Elizabeth Warren 'has proposed unwinding the Google-DoubleClick merger'.

Google's platform Adwords, which is Google Search's ad platform, allows advertisers to buy ad spaces from AdX, DoubleClick's ad exchange. So Google Properties are driving sales to AdX. According to the Wall Street Journal, Google now also allows rival exchanges to sell ad spaces on Google Adsense.

This showcases how connected all these different platforms are, and how difficult it is to comprehend Google's dominance in the digital ad market.

Any regulator diving deep into Google's business model is facing multiple problems. First, they need to understand Google's business very well, to be able to comprehend all the moving pieces. After that, they face the problem of how to showcase the dominance, because frankly, Google's business model is more complicated than one might think.

"I’m hoping that we bring it to fruition early summer, and by fruition I mean, decision time.” ~Mr. Barr, referring to the Google probe.

However, the most difficult question, in my opinion, for any regulator going after Google, is how to combat this dominance. Splitting up the companies into a separate Google properties entity and a DoubleClick entity might not solve the problem entirely, yet could be an improvement. One scenario I can imagine is the separate firms just buying the data from each other, but at least now, in theory, other big players would be able to attain the data as well, though Google's capital makes it hard to outbid them. This creates a somewhat fairer playing field.

In general, a split-up of Google and DoubleClick might be very difficult, according to lawyers who spoke to CNBC. The problem is that over time Google and DoubleClick have become very intertwined, making it challenging to split them up.

"Courts are very concerned that by ripping a company apart, it hurts consumers and make it worse for people that don’t have the expertise to do that"~Stephen Houck, Google advisor

The group of states have not ruled out the possibility of trying to split Google up according to CNBC sources. The question regulators and potentially judges need to answer is whether a split-up does more harm than good or more good than harm.

In 2008 the Federal Trade Commission had to decide whether Google was allowed to take over Doubleclick. Eventually, they gave their permission. According to the Wall Street Journal, a former FTC official said:

"At the time, it seemed like the right decision, but things changed a lot in the last dozen years"

I believe it is somewhat likely that regulators will try to split up Alphabet and DoubleClick. I suspect that it could weaken Alphabet's moat in the digital ad market quite substantially.

AndroidAccording to Politico sources, one other potential settlement would involve Google spinning off its control of the Android mobile operating system. This has been a controversial topic for years. Android has a dominant market share in the mobile operating system market.

(Source: statcounter)

(Source: statcounter)

This is, in my opinion, is the biggest risk to Alphabet shareholders, since Android is a very valuable operating system, and regulators might make an adequate case that Google should not own Android. Alphabet uses Android to force its own Google properties, YouTube, Chrome and Gmail, onto Android customers, which does not bode well with the fair market principle and strengthens its dominance in multiple market segments. And it is quite a rodeo to remove the pre-installed apps. Remember, more data means more effective ads, and so Google is using Android's dominance to acquire more data with its Google properties about users. The European Commission actually fined Alphabet with €4.3 billion for using Android's dominance to 'strengthen dominance of Google's search engine'.

"The Commission decision concludes that Google is dominant in the markets for general internet search services, licensable smart mobile operating systems and app stores for the Android mobile operating system."~European Commission

"Google's practice has therefore reduced the incentives of manufacturers to pre-install competing search and browser apps, as well as the incentives of users to download such apps. This reduced the ability of rivals to compete effectively with Google."~European Commission

I deem it as very plausible that eventually, Android needs to be separated from Alphabet, or that Android is no longer allowed to be pre-installed with some of the Google properties. They also own the biggest ad-exchange AdMob for third-party apps, this is very comparable to DoubleClick's ad exchange that also connects advertisers with advertising spaces. I imagine regulators might be critical of Google owning AdMob, and the strategy used to grow AdMob. According to Reuters:

"The biggest choice for many app creators is between Google’s AdMob and DoubleClick. It is not clear which is growing faster because Google does not provide that data."

"Still, Google’s strategy is winning customers. Google gives developers about 70 cents of every $1 it collects from ad buyers, compared to 50 cents to 60 cents at some competitors."

Android

is another piece of the complicated Google puzzle, this section

showcases again how intertwined all different Google Properties truly

are.

Android

is another piece of the complicated Google puzzle, this section

showcases again how intertwined all different Google Properties truly

are.

(Source: statcounter)

ChromeGoogle's successful browser Chrome might also be involved in any potential settlement with regulators. According to statcounter, Chrome has a whopping 64% market share of the browser market. The success of the browser can be partially associated with its well-built foundation, but its success is not caused by technical details alone. Google preinstalls Chrome on Android devices, and Chrome is practically advertised on Google search and some other Google properties.

(Source: Techdows)

Google used its dominance in other areas to force Chrome

onto users. I see it as unlikely that Chrome is separated from the

entire company by a regulator, but I deem it as likely that Chrome will

undergo some minor change. This might involve Google no longer using its

other properties to gain Chrome users.

(Source: statcounter)

TACTraffic acquisition costs, TAC, are a great way to determine whether Google is using its dominance in some market segments to lower the costs of acquiring traffic to its services. These traffic acquisition costs include 'partnerships and distribution deals'. Partnerships can be websites, apps or YouTube channels, that are using Google's DoubleClick, AdMob or Adsense program, the third party's share of the revenue is a traffic acquisition cost for Google. In distribution deals, Google, for example, pays companies to include Google software on their phones.

Google can, in theory, use its ad dominance to lower the TAC. For example, Google can take a bigger slice when putting ads on third-party properties, this is the DoubleClick and AdMob platform we discussed. There are many ways Google can use its dominance to lower the TAC. But one thing is clear, the TAC costs relative to Google's revenues have decreased over time. One side note, this includes all Google Properties, and so also Google Search and Gmail. Since Google owns Google Search and Gmail, and both services have strong moats, the TAC/Revenue will be very low. What the trend is revealing is that Google has been able to expand gross margins. My guess is that Google Search is the driving factor. Yet there are many factors in play making it hard to determine what has driven the TAC/revenue down.

(Source: Fourweekmba)

(Source: Fourweekmba)

From 2018 to 2019 the TAC share of Google's revenues decreased from 19.65% to 18.26%. Again, this showcases that Google is continuing to grow revenues while expanding its gross margins. A great business model. However, this also showcases that Google might be abusing its power for shareholders. That is the question regulators need to answer.

Wonderful companyAlphabet is the conglomerate with Google as one of its subsidiaries. Alphabet's consistent revenue and EBITDA growth have been stellar, to say the least. Google's profitable search business has been the strong foundation that has given Alphabet the capital to grow extensively.

Alphabet

is very slowly diversifying its company away from Google Search and

other Google properties. Every year Google's Search share of Alphabet's

total revenue has declined and I expect this trend to continue.

Currently, Google is creating most of the value for Alphabet

shareholders since Google's operating income in Q1 2020 was $9.270

billion and Alphabet's operating income $7.977 billion, this means

Alphabet's newer investments are currently losing the company money.

Except these are long-term investments and include money-losing

companies like SpaceX and Waymo that are ready to change the world.

Alphabet

is very slowly diversifying its company away from Google Search and

other Google properties. Every year Google's Search share of Alphabet's

total revenue has declined and I expect this trend to continue.

Currently, Google is creating most of the value for Alphabet

shareholders since Google's operating income in Q1 2020 was $9.270

billion and Alphabet's operating income $7.977 billion, this means

Alphabet's newer investments are currently losing the company money.

Except these are long-term investments and include money-losing

companies like SpaceX and Waymo that are ready to change the world.

(Source: Visualized in Excel, data from Alphabet IR)

(Source: Visualized in Excel, data from Alphabet IR)

Owning Alphabet comes with regulatory risks. The showdown between regulators and Microsoft in the 1990s is a comparable situation. Microsoft (MSFT) was in an antitrust suit with the DOJ, the DOJ was trying to make the case that Microsoft was using its operating system dominance to grow Internet Explorer. They came to a settlement where Microsoft, among other things, had to accept other browsers on Windows. Without this suit, in my opinion, Google could have never existed. Microsoft's Bing would have been the Google of today. The irony is that Google might not be respecting the free market, that gave Google the opportunity to exist. This gigantic lawsuit in the 1990s against Microsoft tarnished the strong brand of Microsoft, and slowed Microsoft down in terms of innovation:

'There’s no doubt that the antitrust lawsuit was bad for Microsoft, and we would have been more focused on creating the phone operating system and so instead of using Android today you would be using Windows Mobile.'~Bill Gates

Nicholas Economides, a respected academic, also wrote an extensive analysis of the Microsoft antitrust lawsuit, while it was still ongoing. He wrote:

'The biggest loss to Microsoft is the continuous antitrust scrutiny that does not allow it to make significant acquisitions in telecommunications and the Internet in the United States during the period of intense antitrust scrutiny.' ~Nicholas Economides

Microsoft's example showcases that antitrust suits can be detrimental to the innovation power of a company, that is a risk Alphabet shareholders need to consider.

TakeawayIt is uncertain what the consequences of any potential antitrust suit against Alphabet will be, frankly it is still possible that an antitrust suit never gets filled. I do believe that any antitrust case can lead to a weakened dominance in some markets. For example, Google Chrome might lose market share, Google might have to leave the mobile operating system market, Google might have to spin-off Doubleclick and/or Admob, and Google's innovation power might be weakened if a hypothetical antitrust case takes ages, and starts getting heated. These are realistic examples that result in Google's dominance being weakened. These hypothetical scenarios will obviously affect Alphabet shareholders, but I suspect less than people might fear. 73% of Google's advertising revenues in 2019 comes from Google Search, only 17% from Google Network Members, that includes Admob and Doubleclick. I also suspect that the margins of Google Search are much higher than of the other Google advertising segments. I find it unplausible that Google Search revenues will be affected significantly, and since these contribute a majority of the profits, I deem any consequences to the bottom line to be minor.

In short, I believe investors should not worry too much about regulatory risks, but understand that Google might undergo some change and as a consequence that Google's moat in some areas might be weakened. Alphabet truly is a wonderful company, that has been able to reward shareholders for decades, and I believe they will continue to do so.

Did you enjoy my write-up? I write a lot about internet and undercovered European stocks, remember to follow me to be able to get notified whenever I publish a new article. You can follow me by scrolling back up and clicking the follow button next to my profile.

Disclosure: I am/we are long FB, AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Some of the research contained in this article might not be entirely accurate, as many as sources as possible were used to prove its worth, however inaccuracies may still occur. This article is meant as an analysis to inform investors what any hypothetical antitrust suits might involve. This article is in no way meant to be libelous. I recommend investors to do their own due diligence.

Why Google Pulled Ads From Two Conservative Websites

Two conservative sites had their AdSense ads pulled from their sites. Lost amid the cries of censorship was the real reason the ads were removed: Failure to understand Google’s terms and conditions they agreed to.

That failure led to content violations which caused their advertising to temporarily be removed by Google.

User Generated Content and AdvertisingUser generated content (UGC) is content that is created by site visitors and not the website publisher themselves. On news sites this kind of content takes the form of comments.

News sites in the past focused on presenting current events. The Internet changed not only how content is consumed but it also changed what kind of content is consumed.

Publishers grew to understand that certain kinds of content that makes readers outraged or angry tend to attract more visitors.

Even mainstream news sites craft articles designed to provoke outrage in order to encourage social sharing and high readership.

The downside of that is that commenters are in an agitated state and that can lead to problematic comments being posted, including hate speech.

ADVERTISEMENT

CONTINUE READING BELOW

Why Advertising and User Generated Content Can be ProblematicGoogle has been criticized in the past for showing advertising on pages that are advertisers might not want associated with their brands.

That’s why Google has policies that forbid showing advertising on pages that feature hate speech, speech of an erotic nature, and content that is graphic and violent.

Many brands do not want to be associated with offensive content.

Showing their ads on pages with offensive content sends the signal that the advertisers approve of and support that offensive content.

Advertisers generally prefer that their content do not appear on pages with problematic content.

Publishers are obligated by their agreement to show Google AdSense ads to be mindful of that kind of negative content.

But that doesn’t always happen. Failure to understand AdSense policies is what caused The Federalist and Zero Hedge to become the object lessons of the day.

ADVERTISEMENT

CONTINUE READING BELOW

Google Did Not Ban the News PublishersThe action Google took appears to be what Google calls a Publisher Restriction.

A Publisher Restriction is a TEMPORARY halt to ad serving until offensive content is removed.

The Publisher Restriction system gives publishers a notice that their ads have been temporarily suspended until the policy violation is corrected.

The intent of this system is to give publishers a chance to correct the issue and continue providing ad space that advertisers won’t be upset about.

This is meant to be a gentler approach than an outright lifetime ban.

What happened was not censorship. It was a failure by the publishers to be aware of the AdSense terms and conditions that they agreed to when signing up to show AdSense ads.

This kind of action happens to all kinds of sites. It has ZERO to do with politics and everything to do with violating Google’s policies against problematic content.

Any site that allows user generated content has to keep their comments in line with Google’s terms of service in exchange for the privilege to display AdSense ads.

The Federalist fixed the issue and had their advertising restored.

Google then issued a statement about content that is problematic:

How to Deal with User Generated ContentThere are several ways to deal with UGC. The first is to moderate content. One way to accomplish this is to either pay someone to moderate the commenting community or to enlist responsible users to become moderators.

A good way to prevent problematic UGC is to publish a content policy.

Adding a “Report a Thread” function gives users the ability to report problematic content.

TakeawayBeing an online publisher means having to wear multiple hats. One of the hats is managing advertising on a website. And that means someone needs to be responsible for understanding Google’s AdSense Program Policies.

ADVERTISEMENT

CONTINUE READING BELOW

None of this would have happened had someone at the Federalist and Zero Hedge been on top of the issue of problematic content. All publishers are obligated to understand these policies in order to show advertising because it’s what they agreed to when they joined the AdSense program.

Learn from the ‘Godfather of Google AdSense’ on what gets investors to fund a startup

Entrepreneurs and startups on the lookout for investors and funding is a perpetual, ever-lasting cycle – the kind that has even spurned reality TV shows!

However, much like the spirit of entrepreneurship itself, which rests on going down the offbeat path, is the phenomenon of reverse pitching. The core idea is to flip the script and have investors pitch to startups instead, with the former sharing their operational experience, sector focus, investment thesis, ticket sizes, portfolios and the value propositions that they bring to the table. This is followed by a Q&A Session where founders can ask the investors questions.

Organisations like Amazon AWS, TiE, The Circle.Work, Network Capital, Headstart, etc. are the marketing partners for this series.

Leading the way in making reverse pitching mainstream, and in the process, demystifying startup funding for founders, is Delhi-based Favcy — a venture building platform providing ready-to-assemble digital applications to convert ideas into a venture — with a bi-weekly digital Reverse Pitch session.

The Favcy Reverse Pitch series of webinars have so far featured several big names from the VC space, including Vinod Shankar (Partner, Java Capital), Shashank Randev (Founder VC,100x.VC), Rajul Garg (Founding and Managing Partner, Leo Capital), Satveer Thakral (CEO, SGAN) and Pinaki Aich (CEO, Forward Investments), among others, to conduct successful, engaging sessions on reverse pitching.

Raising the bar higher this coming week, the Favcy Reverse Pitch is now set to host the ‘Godfather of Google AdSense', Gokul Rajaram on Monday, June 8 at 10 am. To register for this webinar, click here.

Gokul currently serves on the executive team at DoorDash where he leads Caviar — a premium food ordering service. He was also instrumental in getting Facebook Ads to go mobile-first, and has served as a senior figure across some of the largest tech companies in the world, namely Google, Facebook and Square.

“This is a great opportunity for founders to understand investors’ investment thesis, ticket size, what makes them invest into companies new trends and much more in a 25 minute chat. They also have the opportunity to ask the investors critical questions in a 15 minute Q&A Session,” said Nischaiy Pradhan, Founding Partner at Favcy.

Here’s why you shouldn't miss this sessionLearn about Gokul Rajaram’s investment thesis

Gokul has made a broad spectrum of investments from Shape Security, People AI to Faire (an online wholesaler catering to resellers), while tech-play is a Business Model Innovation. In this session, he will delve deeper into what makes hand out a cheque.

Critical Startup Evaluation

Gokul will be sharing mental models on how a founder can rate and evaluate themselves and their startup at an early stage on metrics like Product Market Fit, Founder Market Fit, Timing the Market, etc.

Uptrends in the Post-Covid World (Both American and Indian Context)

Gokul will be sharing his views on sectors and opportunities that he thinks will be on the positive side of COVID from the perspective of both the American and Indian markets.

Don’t miss out on this fantastic opportunity to help kick-start your startup’s growth and make use of the seed money to bear much fruit. You can find out more and register for this special session hereWant to make your startup journey smooth? YS Education brings a comprehensive Funding Course, where you also get a chance to pitch your business plan to top investors. Click here to know more.

No comments:

Post a Comment